Freelancers Need Flexible Retirement Options

Entrepreneurs create more jobs than any other sector of the economy, and they are at the forefront of an evolving 21st century economy that is shaping America’s new employment landscape—one where brick-and-mortar storefronts are being replaced by online retailers, and freelancers and contractors are the new version of the 9-to-5 office worker. New scientific opinion polling shows these solo entrepreneurs are doing financially well for the most part, but they struggle to access benefits like retirement plans, and a significant number are not saving anything for retirement. As a result, the vast majority support portable and flexible retirement plans.

Key Findings

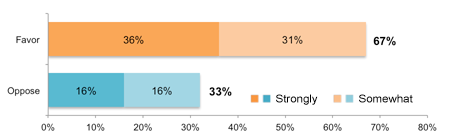

More than two-thirds of small business owners support increasing the federal minimum wage, up from $7.25 an hour, and adjusting it yearly to reflect the cost of living: A 67% majority of small business owners agree the current federal minimum wage of $7.25 per hour should increase, and that it should be adjusted annually to keep pace with the cost of living. Moreover, almost four in 10 (36%) strongly agree.

Two-thirds support increasing minimum wage, adjusting it yearly with cost of living

Do you favor or oppose increasing the federal minimum wage, up from $7.25 currently, and adjusting it annually after that increase is enacted to keep pace with the cost of living?

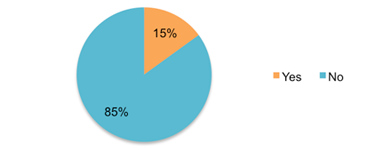

The vast majority of respondents pay all of their employees more than minimum wage: A sweeping 85% of small business owners surveyed do not pay any of their employees the federal minimum wage of $7.25.

Vast majority of small businesses pay employees more than minimum wage

Changing subjects to other issues facing the country and small businesses, do you pay any of your employees the minimum wage?

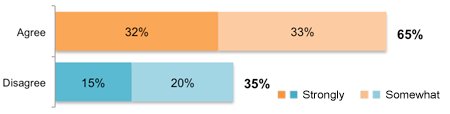

Two-thirds of entrepreneurs believe increasing minimum wage will boost consumer demand for small businesses, helping them grow and hire: A 65% majority agrees with this statement: “Increasing the minimum wage will help the economy because the people with the lowest incomes are the most likely to spend any pay increases buying necessities they could not afford before, which will boost sales at businesses. This will increase the customer demand that businesses need to retain or hire more employees.” Moreover, one-third of owners strongly agree with this statement.

Two-thirds of small business owners believe increasing minimum wage will boost consumer demand and the economy

Do you agree or disagree with the following statement regarding the minimum wage?

Increasing the minimum wage will help the economy because the people with the lowest incomes are the most likely to spend any pay increases buying necessities they could not afford before, which will boost sales at businesses. This will increase the customer demand that businesses need to retain or hire more employees.

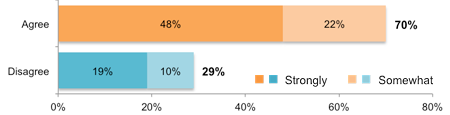

Maine and New Hampshire small businesses believe the expanded use of renewable energy sources can have economic benefits and provide new business opportunities for entrepreneurs: A vast 70% of small businesses agree the expanded use of renewable energy sources such as solar and wind power can have economic benefits for small business owners such as lowering utility bills and providing new business opportunities.

Small firms agree the expanded use of renewable energy sources can have economic benefits for small business owners

Do you agree or disagree with the following statement: the expanded use of renewable energy sources such as solar and wind power can have economic benefits for small business owners such as lowering utility bills and providing new business opportunities for entrepreneurs?

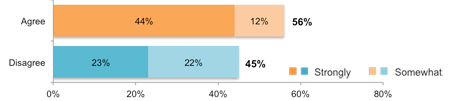

Maine and New Hampshire small businesses believe government can play an important role in creating financial incentives that help small businesses: 56% of Maine and New Hampshire small businesses believe government can play an important role in creating financial incentives that help small businesses take energy efficiency measures, saving businesses money and reducing energy consumption.

Owners agree government can play an important role in creating financial incentives that help small businesses take energy efficiency measures

Do you agree or disagree with the following statement: Government can play an important role in creating financial incentives that help small businesses to take energy efficiency measures, saving businesses money and reducing energy consumption?