Our Research: Retirement Security

While small business owners spend their days concentrating on whatever their particular specialty is--be it marketing services, dry cleaning or landscaping, there's one thing they all have in common: they have to contend with a host of larger issues ranging from employee pay and benefits, medical leave issues, nondiscrimination and more. These are issues they deal with often times on a daily basis, which means they know better than most what kind of solutions would be helpful when shaping public policy. The topics below clearly outline small business owners' opinions on these important workforce topics.

Policymakers at all levels, from town councils to the halls of Capitol Hill, emphasize the challenges of small businesses as a key talking point during political debates. But new opinion polling in four states—Illinois, Missouri, Virginia and Wisconsin—reveals small businesses feel their government officials don’t actually understand their challenges, and they support a wide array of policies to address their needs, some of which might come as a surprise to their elected officials.

Recent scientific opinion polling reveals small business and freelancers need more flexible retirement options. The poll found small employers struggle to offer retirement benefits, and are increasingly turning to independent workers to meet their needs. Additionally, small employers overwhelmingly support state-administered retirement savings plans and other policies that would make it easier for them to offer retirement benefits.

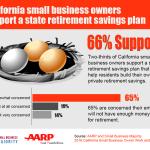

A scientific opinion poll released by AARP and Small Business Majority shows a strong majority of California small business owners support the creation of a voluntary, portable retirement savings program that would allow employees to more easily save for their financial future. What's more, small business owners believe offering such a program to their employees would give their business a competitive edge.

Scientific opinion polling found the majority of millennials who own a business or would like to start one at some point say student debt and a lack of retirement savings plan are barriers to entrepreneurship.

In every aspect of building a thriving society and economy—from addressing long-term unemployment to providing high quality jobs—American entrepreneurship represents a pathway to success, particularly among young Americans who struggled to get their foot in the door during the Great Recession...

The economy is improving, but Illinois small business owners and their employees are facing another financial hurdle: retirement security. The U.S. currently suffers from a retirement savings gap of more than $6 trillion, and more than 38 million households do not have any retirement savings at all. Illinois small business owners and their workers are no exception.

Though the U.S. is slowly recovering from the effects of the Great Recession, Washington small business owners and their employees are facing another financial crisis: retirement security.